Amongst these, the Debt-to-Assets Ratio holds a pivotal position in understanding how a business or particular person manages debt relative to its property. This ratio is a measure of leverage that signifies the proportion of an organization’s assets that are financed by way of debt. But why is that this ratio so crucial, and how can it impact the choices of buyers, collectors, and business owners? Let’s delve into the intricate particulars of the Debt-to-Assets Ratio, its calculation, interpretation, and broader implications. As with all other ratios, the development of the whole debt-to-total belongings ratio should be evaluated over time.

What Is The Debt Ratio?

By implementing these strategies, both people and businesses can effectively lower their debt levels, scale back curiosity expenses, and enhance their debt to asset ratios. Consistent utility of these methods can result in extra robust financial well being and larger operational flexibility. For Firm A, 40% of its belongings are financed through debt, suggesting a average degree of leverage that could be acceptable in lots of industries. To illustrate the calculation of the debt to asset ratio, let’s contemplate two hypothetical corporations. Every example demonstrates different leverage levels to focus on the ratio’s impression on financial assessment. Boeing’s debt to asset ratio provides a putting example of how accounting ratios can both reveal and conceal monetary realities.

Lastly, enchancment comes from an integrated method to financial ratio analysis. By examining debt to asset ratio interpretation alongside different investment danger metrics, businesses achieve a comprehensive view of their monetary leverage which means. This allows for proactive corrections earlier than monetary danger indicators turn into threats. On the asset facet, firms can give attention to strengthening their base by way of retained earnings, equity financing, and strategic acquisitions. By growing the worth of assets relative to liabilities, the entire debt ratio improves naturally over time.

Debt-to-assets Ratio Vs Return On Belongings (roa)

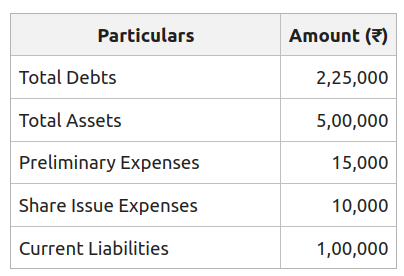

The ratio is extensively considered a crucial measure of leverage ratio exposure and long-term financial stability. Debt to asset indicates what quantity of a company’s property is financed with debt quite than equity. The formula is derived by dividing all short-term and long run debts (total debts) by the mixture of all current belongings and noncurrent assets (total assets). A good debt to asset ratio helps in the evaluation of the proportion of assets which might be being funded by debt is-à-vis the share of belongings that the investors are funding. The debt to asset ratio impacts an organization’s financial well being by indicating the extent of economic leverage and threat.

This ratio is classified as a solvency ratio, which provides insights into a company’s monetary well being and stability. The major use of debt-to-asset ratio is to measure a company’s financial leverage. This calculation yields a decimal or percentage that signifies the extent to which an organization’s assets are financed by debt. A higher debt ratio means that a larger portion of the property is funded through liabilities, which can indicate greater financial https://www.personal-accounting.org/ threat. Conversely, a decrease debt ratio indicates that a smaller proportion of assets is financed by debt, usually making it a safer investment option.

Why Must You Use The Debt To Complete Belongings Ratio?

If the company has a high debt burden, nonetheless, it could be unable to make such selections as a outcome of debt to asset ratio formula its interest and principal funds make it unable to tolerate even a short-term decline in income. Apple has a debt to asset ratio of 31.43, compared to an eleven.47% for Microsoft, and a 2.57% for Tesla. All three of these ratios would usually be seen as low, leaving all three firms with ample room to extend their leverage sooner or later if they need to do so.

We examine its position in debt management, its use as a monetary risk indicator, and its broader significance in funding risk metrics. Of all of the leverage ratios used by the analyst community to know the monetary position of an organization, debt to assets tends to be one of the less frequent ones. The first group uses it to judge whether the corporate has sufficient funds to pay its money owed and whether it might possibly pay the return on its investments. Creditors, on the other hand, assess the potential for giving further loans to the corporate. If the debt-to-asset ratio is exceptionally excessive, it signifies that repaying current debts is already unlikely, and further loans are a high-risk investment.

One approach to obtain improvement is by lowering reliance on external borrowing. This can be accomplished via debt repayment packages, refinancing at decrease rates of interest, or shifting away from short-term obligations to extra sustainable long-term debt buildings. Efficient debt administration ensures that leverage ratio pressures stay within acceptable bounds. Bettering a debt to asset ratio requires a deliberate blend of financial self-discipline and strategic planning. Companies that actively manage their liabilities vs assets can strengthen their solvency ratio outcomes and improve their credit score danger profile. In other words, the ratio doesn’t capture the company’s complete set of money “obligations” which are owed to exterior stakeholders – it only captures funded debt.

It is certainly one of many leverage ratios that might be used to grasp a company’s capital structure. The debt ratio plays a significant role in serving to assess the financial stability of a firm, given the variety of asset-backed debts it possesses. It compares the total debt with respect to the corporate’s whole property and is represented as a decimal value or in the form of a proportion. While the Debt to Asset Ratio is a useful software for understanding a company’s monetary place, it’s not with out its limitations. One of its major drawbacks is that it doesn’t distinguish between kinds of assets—whether they’re liquid or illiquid, tangible or intangible. To assess the kinds of property and their liquidity, see this liquidity ratios article.

- Suppose the company had assets of $2 million and liabilities of $1.2 million.

- Moreover, regional rules and market dynamics can affect an appropriate debt ratio, necessitating adaptability in financial analysis.

- This is as a outcome of it is dependent upon the business model, industry, and strategy of the company in question.

The ratio is used to measure how leveraged the company is, as larger ratios point out extra debt is used as opposed to fairness capital. To acquire one of the best perception into the entire debt-to-total property ratio, it’s usually greatest to match the findings of a single company over time or the ratios of similar corporations in the identical business. This ratio helps traders and analysts understand the monetary structure of a company and assess its monetary risk.

This written/visual materials is comprised of non-public opinions and ideas and will not replicate these of the Firm. The content shouldn’t be construed as containing any sort of investment advice and/or a solicitation for any transactions. It doesn’t imply an obligation to buy funding services, nor does it guarantee or predict future performance. On the opposite end, Company C appears to be the riskiest, because the carrying worth of its debt is double the value of its property. A company with a lower proportion of debt as a funding supply is alleged to have low leverage. A company with a higher proportion of debt as a funding source is alleged to have high leverage.